Bitcoin Blues? Bitcoin Clues?

By HanseCoin/KJA Digital Asset Investments/VSI on ALTCOIN MAGAZINE

By Hanse Digital Access, KJA Digital Asset Investments and Virtue of Selfish Investing on ALTCOIN MAGAZINE

Riding the Revolutionary Rocket with Cryptotechnologies… Entirely Evolutionary™

Bitcoin Blues?

I have had questions on whether the current correction in bitcoin is different than prior corrections. Indeed, bitcoin typically corrects between -28% and -42% during bull markets. Such a correction looks minuscule in the context of bitcoin’s overall price chart. The current correction of -53% is no different. Such came about due to a confluence of events, namely the recent Chinese crackdown on crypto exchanges, U.S. investors selling bitcoin in order to record negative performance for their end-of-year tax obligations, and the raid on Binance offices in Hong Kong which proved false but still contributed to the negative sentiment. There are also companies putting out digital gold-backed by gold which could take some market share from bitcoin. But gold can still be controlled by governments just as the U.S. once did in 1935 when they made it illegal to hold physical gold. Bitcoin, on the other hand, can be masked, much as the transactions of private coins such as Monero and Zcash can be hidden.

Bitcoin Clues?

On the bullish front, $6500 level represents the assumed cut-off point for miner profitability which miners would defend. So far, this level has held up as the low in bitcoin hit $6515 on Nov 25 then bounced on appreciable volume.

Other bullish tailwinds besides the ones I’ve detailed in prior reports where I list numerous fundamental and technical metrics I have used to call major tops and bottoms in bitcoin since 2011 show that at the present moment, a number of these metrics are neutral suggesting the bitcoin bull market is still intact. The most relevant metrics at present showing bullish or tipping point behavior are as follows:

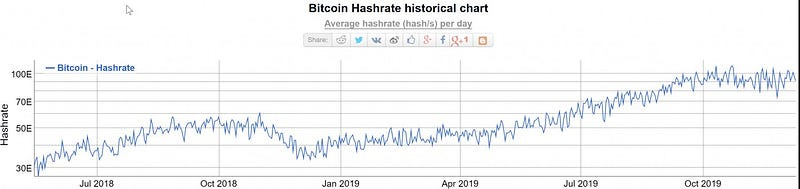

The bitcoin hashrate is near new highs:

and the number of active bitcoin addresses that hold any amount of bitcoin is at all-time highs, surpassing the previous ATH achieved on 1/10/18. The number of bitcoin addresses with a positive balance shows that the approximate doubling of bitcoin’s userbase every year is alive and well, a sign of growing bitcoin adoption.

Also, the number of bitcoin addresses holding more than 1000 bitcoin is in a sharp uptrend not seen since 2013. Of course, the value of bitcoin is two to three orders of magnitude higher than it was in 2013 which suggests it’s not the cypherpunks buying it as they were back in those early years but it is primarily the institutions and high net worth individuals that are buying bitcoin. Barry Silbert mentioned how more than 70% of its bitcoin buyers are now institutional. While much of this institutional money is from small crypto hedge funds, it is nevertheless institutional, akin to small and micro cap mutual and hedge funds that invest in stocks. The tidal wave of institutional capital that will enter the blockchain space will help push its overall value into the trillions in the coming years.

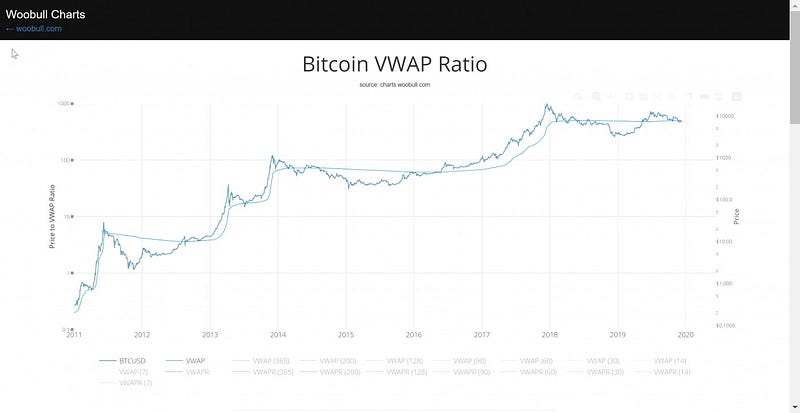

Finally, we have the bitcoin VWAP ratio which underscores how the recent pullback to $6515 should be the low for this current downtrend in the context of the bitcoin bull market. VWAP stands for volume weighted average price the market paid for their coins. During bull markets, when bitcoin has undercut this line, it tends to bounce back above it. Keep in mind the data set is limited to draw any firm conclusions. But if bitcoin drops appreciably below its low of $6515, it would suggest the bitcoin VWAP ratio is behaving differently compared to prior bull markets. It would also mean the miners were unable to defend the $6500 price. Thus at current price levels, bitcoin sits at a tipping point. Stay tuned.

Altcoin Magazine (@Alt__Magazine) | Twitter

The latest Tweets from Altcoin Magazine (@Alt__Magazine). Our goal is to educate the world on crypto and ultimately to…twitter.com