Quantum Jumps in Self-Sovereignty

by Dr. Chris Kacher

(Depicted above in tokenised form 😸)

Cryptotechnologies… Kryptonite for Governments™

Digital Self-Sovereignty

The transition from a trust-based economy to one of self-sovereignty will drive one of the largest wealth transfers in history. Barry Silbert who runs Grayscale and the two ETNs GBTC and ETCG says that 30 trillion dollars will be transferred to the millenials. Silbert’s position comes from the fact that the people in the ‘baby boomer’ generation are either retiring or getting close to retiring. According to a recent Accenture study, $30 trillion in wealth belonging to the generation born immediately after World War II is already being passed down to the younger generation. This generation has taken a pragmatic liking to bitcoin over gold.

Silbert has also mentioned how more than 70% of its bitcoin buyers are now institutional. This illustrates how the big money is starting to get involved in the blockchain space. This is akin to the dot-com boom of the 1990s. Retail investors kicked it off but eventually institutional capital dominated the space by 1999.

Government Control vs. Digital Self Sovereignty

While governments have always attempted to control the flow of money, blockchain undermines their attempts.

Just because something has always happened in the past such as the U.S. government controlling anything to do with money does not mean it will continue to do so with the same level of success. The Chinese government has certainly been undermined by bitcoin despite its on again, off again attempts to squeeze the life out of bitcoin by way of outright bans against certain aspects of the technology. Indeed, many of its wealthy citizens are able to transfer millions outside of the country, overriding the $50,000 equivalent maximum. Russia’s Putin at first banned the technology until they realised its massive utility. Putin met with Vitalik Buterin, the founder of Ethereum, last year.

A major global shift is taking place from centralised forms of power to decentralized platforms which already enable the transfer of value outside of the hands of governments. DAOs (decentralized autonomous organisations) will further facilitate this evolution.

While some believe decentralized crypto exchanges (DEX’s) will cease to exist should the U.S. ban them because that’s the attitude the U.S. has always taken when it comes to the control of money, such exchanges are by their very nature not easily controlled. As an example, peer-to-peer illegal file sharing continues to grow since the days of Napster in the mid-1990s despite the tens of millions of taxpayer dollars used to attempt to quash such decentralized platforms.

While some say the U.S. will simply control the service providers who host such exchanges, VPNs and mesh networks are easy workarounds. In other words, there is always a way to circumvent policy as tech always trumps policy. Further, government tends to be the slow animal in the herd thus policy has been, is, and will continue to be trumped even more so today than ever before as blockchain technology takes hold. That said, our policy at HanseCoin is always to remain compliant. Regulation will help the blockchain/cryptospace mature enabling institutional capital to enter en masse.

Separation of State and Economics

We have freedom of communication to some extent (though any platform can be hacked), but still lack the freedom of value transfer. See my article separation of state and economics.

With the planet mired in record levels of debt with interest rates in many countries at all-time lows, fiat’s days in pole position may be numbered. Fiat is backed by the full faith and credit of the underlying government. As QEndless continues with no end in sight, a massive monetary shift is already starting to occur.

While the Fed hiked rates several times by 25 basis points each time, rates in the U.S. still remained near historical lows since they started from historically low levels. Now with the world teetering on recession, the Fed is faced with having to undo these mini rate hikes. Indeed, the ability of central banks to spur economic growth through monetary policy has diminished considerably over the last few debt cycles. Note in the graph below how the yield on the 10 year has been on a downtrend since it peaked in the early 1980s. Also note the slight uptrend in rates over the last few years as the Fed became increasingly hawkish by hiking rates.

When the Fed attempted to get even more hawkish by reducing their bank balance sheet every month with little end in sight, major stock markets in the U.S. finally gave up the ghost by collapsing by -20% in December 2018. It was the first Christmas crash in U.S. stock market history. Fed Chairperson Powell stepped in to immediately make the proclamation that he would stop reducing the balance sheet and do what it takes to keep the bull market alive.

That was on December 15 and marked the low of the correction which spurred a sharp uptrend up until recently.

Enter the Trade Wars

Since then, the trade wars together with the slowing global economy have taken their toll sending U.S. markets below their respective 200-day moving averages. But President Donald Trump plays the Fed like a fiddle, knowing he can maintain a tough stance on trade as the Fed will simply monetise more debt should conditions deteriorate. Indeed, the Fed’s Powell gave the nod to multiple rate reductions if necessary in the coming months.

In any event, when the next recession hits, the deflationary forces of automation and technology that continue to accelerate, part of the 6 D’s of Peter Diamandis, will replace a growing number of jobs which in turn will further reduce consumer demand.

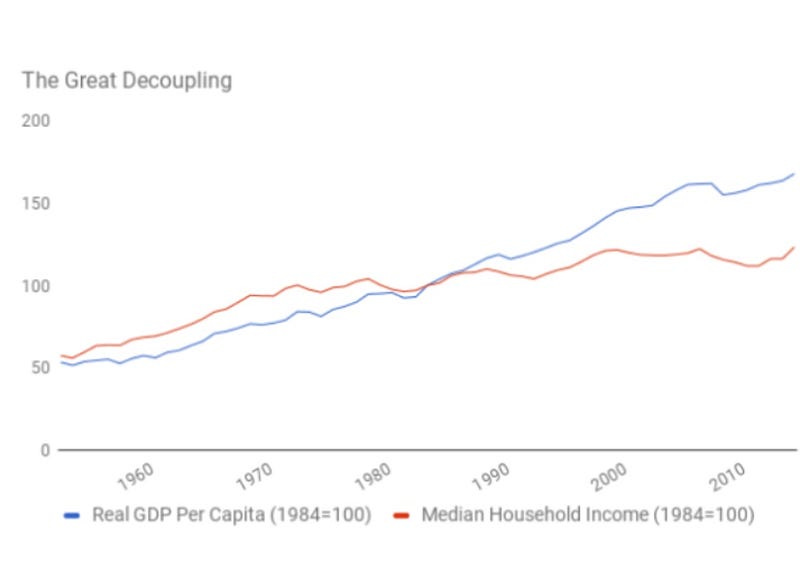

The Great Decoupling

The breakdown of the traditional correlation between US income and GDP growth which occurred in the mid-1980s has been dubbed the “Great Decoupling”.

This decoupling was caused by growing levels of debt which artificially boosted GDP ‘growth’.

Since the CPI is well under what it should be due to the government removing components since the 1980s that rose in price the fastest, even the artificially inflated GDP numbers should be materially lower than reported.

Forbes did an article a few years ago on how the D market (dark market) is the fastest growing market in the world. Note, goods and services exchanged in the D market are not typically of an illegal nature as the D market represents faster and more efficient ways of transacting typically at lower cost. Blockchain tech will accelerate this trend. The total value of the D market at the time stood at $11 trillion vs the U.S. GDP at $16 trillion. Forbes guessed that the size of the D market would overtake the U.S. market within a decade.

Digitally Sovereign Decentralized Platforms

In any respective country, there is only one choice of currency. This is what drives banks’ (and central banks’) margins. The great global monetary shift will foster an ecosystem of many cryptocurrencies for applications existing on digitally sovereign decentralized platforms on the internet and outside the jurisdiction of governments and central banks.

Bitcoin Declared Decentralized

Bitcoin facilitates value transfer. The SEC has declared bitcoin decentralized thus not under regulatory scrutiny. That said, should its layer 2 technology Rootstock get underway in full measure, such companies with centralised authority that utilise Rootstock would have to register with the SEC as securities.

So despite attempts to ban bitcoin by entire nations such as China and Russia, it remains the most secure and private platform due to its massive network effect which continues to grow exponentially. Advantage: S-curve.

HanseCoin, World’s First Compliant Tokenisation Platform

The former CEO of the NASDAQ stock exchange recently said all stocks will be tokenised in 5 years. The CEO of CoinMetro thinks this will happen even sooner. Most anything can be tokenised whether it be a fund manager’s performance, a digital avatar in the gaming world, digital gaming items, and even a person’s “brand”. The renowned angel investor Naval Ravikant would agree. He also said 2 years ago that 90% of jobs on Wall Street will be gone in 7 years. I have said “Transform or die.”

HanseCoin leads the way as it is the only compliant platform with first mover advantage. Its first issued token has an actual underlying use case owned by HanseCoin which is 6.6 hectares of fully permitted, construction-ready land 15 minutes from Tallinn’s city center with a multi-million euro valuation.

The tokens are pegged to the value of the underlying asset in euros thus are not affected by the volatility of bitcoin or any other crypto. A master coin which is a pref share will be issued later in 2019. This coin will represent the underlying value of HanseCoin and more importantly, the exponential growth potential of HanseCoin. This has spurred some analysts to suggest the master coin has strong potential to gap higher upon being listed. HanseCoin VPAT buyers are therefore rewarded by being allowed to convert up to 20% of their tokens into the master coin when the 4–6 month vesting period of the VPAT tokens ends. Given that we are onboarding a variety of projects rather quickly, vesting periods will eventually compress to just a few days. Further, platform dev has progressed significantly so it is likely. the mastercoin will be floated sooner than later.

Buckle up… we’re going into a new era.

(͡:B ͜ʖ ͡:B)