How much longer can the Fed continue to print money before these megabubbles start blowing apart?

By Dr. Chris Kacher of HanseCoin /KJA Digital Asset Investments and Virtue of Selfish Investing on The Capital

By Dr. Chris Kacher of Hanse Digital Access, KJA Digital Asset Investments and Virtue of Selfish Investing on The Capital

The (R)Evolution Will Not Be Centralized™

U.S. Dollar’s Days Numbered?

Going back 500 years and beyond, every fiat currency has had a limited shelf life. In terms of the relative standing of great empires through the ages, the U.S. is on the way down (blue line) while China is on the way up (dotted red line). A well thought out article was recently written by Ray Dalio of Bridgewater on how money, debt, interest rates, and government create the long term debt cycles which lead to the destruction of the world’s reserve currency at that time and gets replaced by a new reserve currency from another country. Ray Dalio runs the world’s largest, most successful hedge funds, Bridgewater. He examines issues from many angles, looking back at numerous historical examples, to gain a decent understanding. Dalio’s article underscores some of the work I’ve published on why the stock market probably won’t retest March lows but continue higher in sloppy fashion with sharp, second order corrections along the way due to the unprecedented economic lockdown/house arrest.

The question has been brought to mind as to how long central banks can continue to print with debt and interest rates at record levels. Questions go something like this:

“With China on the way to becoming the world’s economic superpower, just because the dollar’s holdings go down and the yuan goes up from a very low baseline doesn’t mean a polar shift in the world’s reserve currency from the dollar to the yuan. And just because fiat continues to devalue from limitless QE does not mean a move back to the gold standard when monetarism has left its mark and all states are addicted to monetary policy to smooth business cycles. So as governments try to prime the pump with expansive monetary policies, at what point do you think they will reach the endpoint? There may be a flight to safety, but it’s not as though there are many currencies and commodities of refuge between currencies such as the dollar and Swiss franc, and bitcoin and gold. Or am I missing something?”

A Thousand Years of History

My answer is that as fiat devalues, fiat will invest in more stable assets. This includes gold, stocks, and bonds. Bitcoin has the added advantage of tightening later this month while central banks continue to ease like they’ve never eased before. Real estate and other hard assets depend on demand, so any protracted recession would negatively impact prices even as fiat debases due to any demand shocks.

As for a tipping point, monetary policy addiction by leading governments has always led to the same result if a thousand years of history is any guide. While the trend shows the yuan gaining momentum against the dollar, it doesn’t automatically mean a polar shift where the yuan replaces the dollar as the world’s reserve currency as such shifts take time, and then there is no guarantee that the yuan will emerge as the world’s reserve currency.

If you take the 50k foot view, the long view, the cycle we are seeing unfold is similar to all the others when examining many centuries of history, which is why all reserve currencies go from cradle to grave without exception.

Typically a new reserve currency is born as a new major cycle begins, which occurs after a global collapse of sorts, where a new world order rises, and with it, a new monetary system and new political system. The last one began in 1945 over a period of rebuilding and prosperity when the U.S. was a creditor nation.

Back then, the U.S. government did not bail out the people. The people bailed out the government. It raised taxes dramatically, borrowed money from the people via war bonds, then the people were paid back after the war. Today, a material number of people are broke, companies are broke, governments are broke, and the wealth gap has never been wider.

Post World War II, income growth exceeded debt-service payments. The Fed continued to stimulate credit which continued to boost economic growth. The fuel in the interest rate tank was on full, post-World War II. But since bond yields spiked in the early 1980s, the fuel in the tank has gradually been depleted over the last 4 decades to where it stands today, near empty.

The End?

We are in the final stages of the long term debt cycle, a cycle which averages 75 years in length. Central banks have run out of their abilities to stimulate credit and economic growth effectively. If central banks try to tighten by any material means, the debt bubble will burst, credit will contract, and with it the economy. Politicians who seek reelection have no interest in creating the mother of all recessions, so historically speaking, once debt reaches these levels, there is no turning back. Central banks have little choice but to continue to create money and credit, which will continue to devalue their currencies.

This leads us to where we are today, as the record levels of debt wait to be restructured, which has vast implications as history has shown as it represents the tipping point into a new monetary system, domestic order, and ultimately the world order. A global war has historically been the final ingredient for big change. The cycle is then complete and starts again, at least based on the last millennium’s worth of global economic cycles.

As Mark Twain said,

“History doesn’t repeat but it often rhymes.”

The bursting of the debt bubble, or more gently known as debt restructuring, will lead to a severe global economic contraction. Given the large wealth gap, this will spur social unrest within nations and against other nations. This internal and external fighting will lead to domestic and international political and structural transformations.

Where Best To Invest

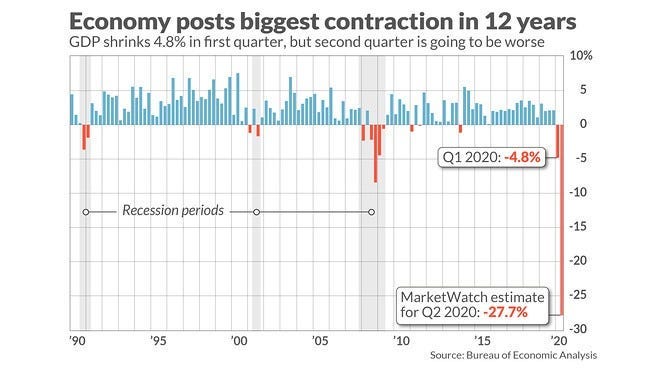

Singularly, the world is close to The Tipping Point, but that’s on a relative timescale, which is long, thus this money printing can easily go for another few years as central banks attempt to stretch QE to infinity. Nevertheless, the economic shockwaves from second order effects due to the lockdown will be felt for many quarters out. Fiat debasement will continue to accelerate while economies blow apart plunging the world into deep recession and with it, prices of real estate and other hard assets.

But we will get a sharp bounce later this year. In the meantime and after, stocks, bonds, and gold should continue to benefit. Bitcoin even more so as it is an asymmetric, nearly non-correlating, and exponential grower reflected in its price since its creation in 2009. The arguments are always the same. It has no value. Its bubble has burst. What if the government bans it? Yet $1 worth of bitcoin in 2009 is worth around $8 million today, a reflection of deep fiat debasement in this era of QE, and the prime directive as to why Satoshi Nakamoto created bitcoin in the first place. So as the world prints its way out of COVID-19, there will be an increasing urgency for capital to find safe haven assets, which should be another huge tailwind for bitcoin.

The fate of real estate and other hard assets depends on how deep and long the recession lasts. That said, the recession may be shorter than expected due to limitless liquidity. If we are back in 1932 when markets started on a sharp rally that kept going, overall, until 1937, then the recession may be limited to the second (and maybe third) quarter despite the catastrophic blows to the global economy as we bounce in the 3rd (or 4th) quarter.

The timing of the lockdown lift is key though the amount of fear being spread by often leftist-driven mainstream media affects readers thus impacts the legislative decisions made by those with high levels of political power running their respective country. It doesn’t help that the often leftist-driven press reported last Tuesday that “Germany started to lift restrictions too soon which caused the infection rate to climb.” The numbers used to draw such conclusions are often misinterpreted, exaggerated, or taken out of proper context. This news was then spread across numerous media channels. At any rate, CME Fed Futures are pricing in 0% interest rates over at least the next 12 months, while other central banks such as Japan are pushing rates even more negative.

Exponential Growth Technologies

All that said, another wildcard which the likes of Ray Dalio et al have not considered is the exponential growth of tech- AI, VR, blockchain, et al which will help elevate health care, logistics, e-learning/education, work-from-home, and home entertainment, among other industries. Stocks that dominate these areas are the FAANG names as well as MSFT, AMD, and maybe INTC.

At any rate, this level of growth potential in tech has never existed in history. It could possibly extend the length of this long term debt cycle. Dalio refers to it as the 75-year long-term debt cycle though acknowledges this is just a rough average.

So maybe this time is different. So far, liquidity has never been this unlimited. Yes, interest rates have been at 0% but only for very brief periods such as in 2008, and not in the 1930s as only 3-mo T-bills were near 0% while the discount rate remained above 1–2% (roughly). Global debt is at all-time highs or 322% of GDP.

U.S. markets have never fallen faster or shot higher in this timeframe. Together with exponential growth tech companies that have access to the cheapest liquidity in history, this could profoundly impact economies in a positive direction, or at least mitigate the second order effects spurred on by the unprecedented lockdown.

Either way, one thing seems highly likely: the flight to non-depreciating assets as fiat continues to devalue. Bitcoin and gold stand to benefit the most over the long run as they are recession-proof, much as gold proved after the crash of 2008 as it was the first asset to hit new highs. Expect something similar this time around, but this time, bitcoin will also be included as its creation came after the crash of 2008.

The Capital

The latest Tweets from The Capital (@thecapital_io). The Capital is a financial micro-blogging social networking…twitter.com