Our Main Picks Are Hitting Bullseyes

By Dr. Chris Kacher of HanseCoin /KJA Digital Investments and Virtue of Selfish Investing on The Capital

By Dr. Chris Kacher of Hanse Digital Access, KJA Digital Investments and Virtue of Selfish Investing on The Capital

As I always focus on quality over quantity, the vehicles we have discussed numerous times over the last year continue to outperform for our members. A few examples:

=Gold in all its forms (the metal itself, miners, junior miners, etc) which hit a 7-year high yesterday. Issued the first in a series of buy signals on Jan 7, 2019, then again on May 14, 2019.

=Bitcoin (ETN GBTC) as its bull market appears to have resumed. Issued the first in a series of buy signals on March 18, 2019, which was to my knowledge the first major buy signal on bitcoin when most others were still bearish.

=TSLA — buy signal came at 348 on Dec 10, 2019. It is looking to gap higher after an analyst upgraded its price target.

=SPCE — https://www.virtueofselfishinvesting.com/reports/view/pocket-pivot-review-spce-2-10-20

=SHOP — buy signal came when it was still trading near 330: https://www.virtueofselfishinvesting.com/reports/view/pocket-pivot-review-shop-pkt

In the cryptospace:

Chainlink (LINK): On Apr 2, 2019, I put out the first buy signal on LINK.

Enjin (ENJ): On Mar 1, 2019, I put out the first buy signal on ENJ.

In my own portfolio, I have bought both of the above coins several times. As consequence of my pyramiding strategies and price performance, they are the two largest holdings in the portfolio I manage. Bitcoin is my third largest.

I often buy an outperforming coin more than once while reducing the exposure of coins that lag. Strength begets strength. Over time, the organic effect is a concentration of capital into the better performing coins with the aim to beat out bitcoin by large margins such as I’ve done in past bull markets such as in 2013 and 2017.

My strategy in a nutshell:

Since bitcoin is the coin to beat over any given cycle, buying the right names takes much in-depth analysis. The asymmetry in cryptocurrencies is like no other. During bull runs, 10-fold gains are standard while 100-fold gains are possible. If you are sitting on 9 coins that die, and 1 coin is a 10-bagger, you still break even. In practice, since there is still a high degree of correlation, odds favor more 10-baggers than zero-baggers provided the right names are bought.

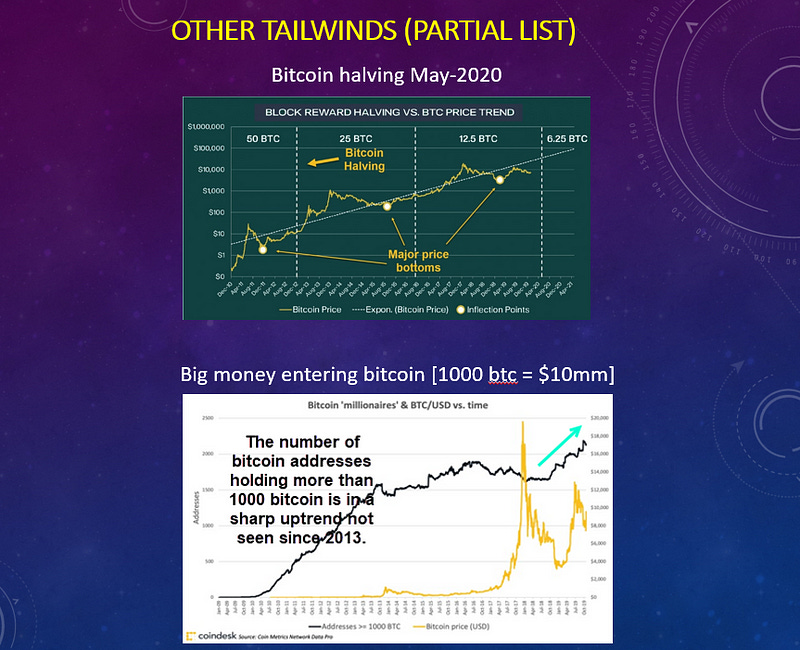

In the late 90s, dot-coms had a huge run but this was due to institutions piling on board. The crypto space has yet to have this occur as 2017 was driven by retail money. In the current bull market, it is highly likely institutions will be a significant factor of the next crypto bull. We are 15 months into the bull market with bitcoin having bottomed in Dec-2018, so another year or two of bull activity in bitcoin and the best altcoins is certainly possible given the numerous tailwinds as well as the guiding light of history.

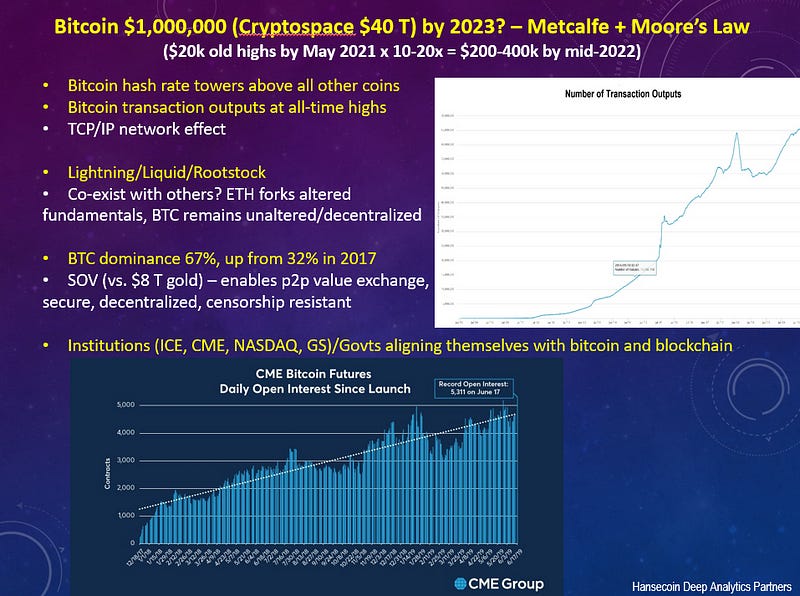

Here are a few examples of tailwinds at bitcoin’s back. My prediction of $1,000,000/BTC I made in my keynote speech at the FinTech conference in Geneva in Nov-2017 still stands based on bitcoin’s historical price trends and the number of tailwinds in play:

Note on Bitcoin (BTC): My metrics, some of which are shown in the graphics above, have called every major top and bottom in bitcoin within a few weeks or less and sometimes to the day. On January 30, 2018, I personally went to cash selling all my cryptocurrencies on this date due to my metrics issuing a major sell signal in bitcoin. I then only bought Binance (BNB) later in 2018. My 2018 performance: +528%. Average cryptofund in 2018: -53%. We then sent out buy signals on GBTC on March 18, 2019.

A couple of examples of my buys and sells:

When “thought(less) leaders” such as Nouriel Roubini make declarations that bitcoin has no value, I have refuted the arguments in various published pieces HERE and HERE and HERE as well as in this slide:

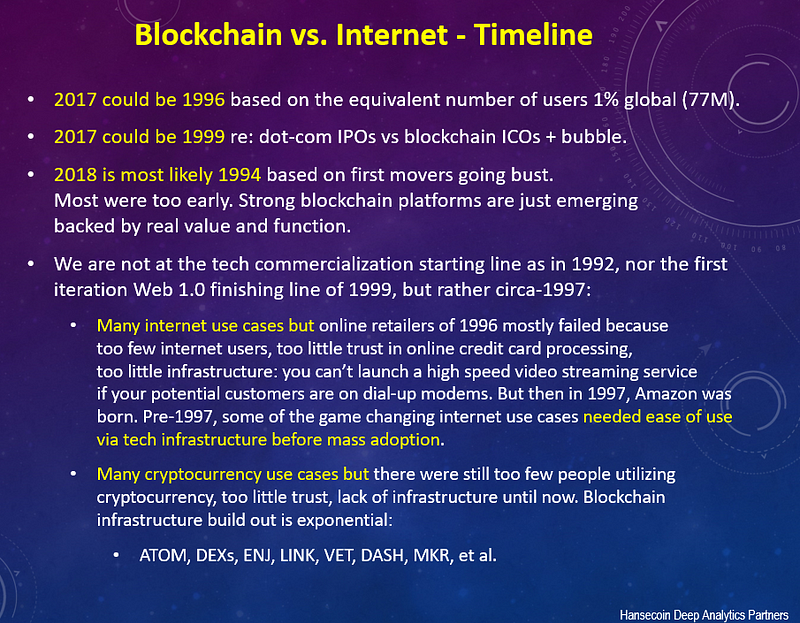

Ultimately, the crypto/blockchain space is just getting started. Here’s a comparison of the timeline between blockchain and the internet:

We’re going into a new era. Buckle up!

(͡:B ͜ʖ ͡:B)

The Capital

The latest Tweets from The Capital (@thecapital_io). The Capital is a financial micro-blogging social networking…twitter.com