Our Main Picks Are Hitting Bullseyes

by Dr. Chris Kacher of HanseCoin /KJA Digital Investments and Virtue of Selfish Investing

by Dr. Chris Kacher

If you google my name, you will see that I am known as a market wizard in stocks based on my KPMG verified track record as well as my numerous publications in books (Wiley & Sons is my main publisher) and articles (MarketWatch, Forbes, Technical Analysis of Stocks & Commodities, et al). I was market legend William O’Neil’s top performer among his hand-picked group of portfolio managers. My AUM for O’Neil grew into low 9-figures.

That said, the cryptospace has the highest risk/reward characteristics of any space, dwarfing even what dot-coms did in the late 1990s. In early 2013, I designed a number of metrics which I continue to evolve so I can continue to identify major tops and bottoms in bitcoin sometimes to the day when it comes to climax tops or massive capitulations.

Since 2013:

Jan 8, 2013: major buy sig

Apr 10, 2013: major sell sig

Oct 14, 2013: major buy sig

Dec 11, 2013: major sell sig

Jan 15, 2015: major buy sig

Jan 30, 2018: major sell sig

March 18, 2019: major buy sig

The above is backed up by my actual trades and/or time-stamped market calls for various publications. My metrics have worked back to 2011 on a backtested basis while the above market calls were all done in real-time. Backtests are always highly suspect unless proven in real-time.

As I always focus on quality over quantity, the three cryptocurrencies I have mentioned a number of times over the last year, shown below, represent the bulk of my holdings.

Chainlink (LINK): On Apr 2, 2019, I put out the first buy signal on LINK. As of Feb 20, 2020: +723.0%. LINK has secured deals with most of the majors including Google, Oracle, Microsoft, Intel, and Cisco Systems. Its market cap is currently around $1.4 billion making it the 12th largest coin. Given it’s first mover advantage, network effect, and deals in the pipeline, its market cap could easily soar 10-fold to $14 billion. Its killer app is its decentralized oracles which enable communication between on-chain and off-chain blockchains. Oracles act as agents to verify real-world data and prepare it to be recorded in a smart contract on the blockchain. Chainlink connects smart contracts to real world data, events, and payments and aims to build bridges between payment services like PayPal and Visa, banks like HSBC and Wells Fargo, and blockchains like Ethereum and Bitcoin. Blockchain interoperability is the key to blockchain’s future success.

Enjin (ENJ): On Mar 1, 2019, I put out the first buy signal on ENJ. As of Feb 20, 2020: +93.6%. ENJ tokenizes digital gaming items and develops games on blockchain where players can tokenize assets and characters. Since the games are decentralized, the digital items and characters have value across all gaming platforms. ENJ has been mooning since its deal with Microsoft on Dec 6, 2019. ENJ is potentially the dominant force in the non-fungible token (NFT) market.

The third coin is Bitcoin (BTC) as bitcoin is the coin to beat over any given cycle which includes both bull and bear markets. I give material reasons below.

In 2019, I had bought 12 coins which I pared down to 7 coins which continue to outperform for our members. One key to investing is to force feed capital into top performers while paring back or outright selling the weaker sisters. Here is the current list of coins I have recommended to members.

Indeed, pyramiding into the right names takes much in-depth analysis.

In my own portfolio, I have bought BTC, LINK, and ENJ several times since early 2019. In consequence of my pyramiding strategies and price performance, they are currently the three largest holdings in the portfolio I manage. I own a total of 7 coins as of this writing but am eyeing the few coins that are now outperforming bitcoin. Ethereuem (ETH) is looking more promising after Vitalik Buterin’s recent statement on ETH 2.0. Prior to this, there was much misinformation put forth on material delays until at least 2021. In reality, ETH will continue to significantly evolve throughout this year and next.

Competitor Tezos (XTZ) has been one of the top performers as its scalability exceeds that of ETH while its self-correcting protocol and on-chain governance enable it to manage network modifications such as improvements in scalability.

I often buy an outperforming coin more than once while reducing the exposure of coins that lag. Strength begets strength. Over time, the organic effect is a concentration of capital into the better performing coins with the aim to beat out bitcoin by large margins such as I’ve done in past bull markets such as in 2013 and 2017.

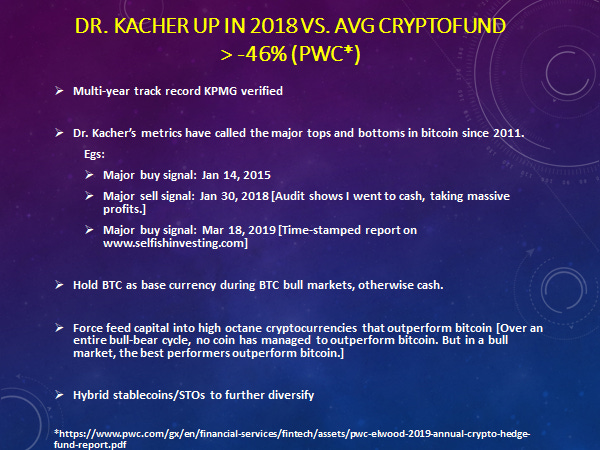

My strategy in a nutshell:

The asymmetry in cryptocurrencies is like no other. During bull runs, 10-fold gains are standard while 100-fold gains are possible. If you are sitting on 9 coins that die, and 1 coin is a 10-bagger, you still break even. In practice, since there is still a high degree of correlation, odds favor more 10-baggers than zero-baggers provided the right names are bought.

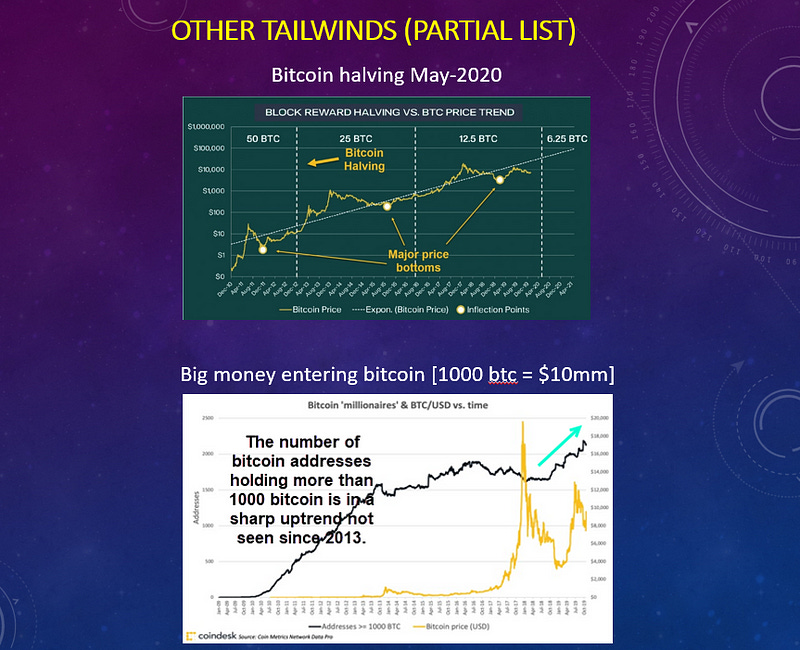

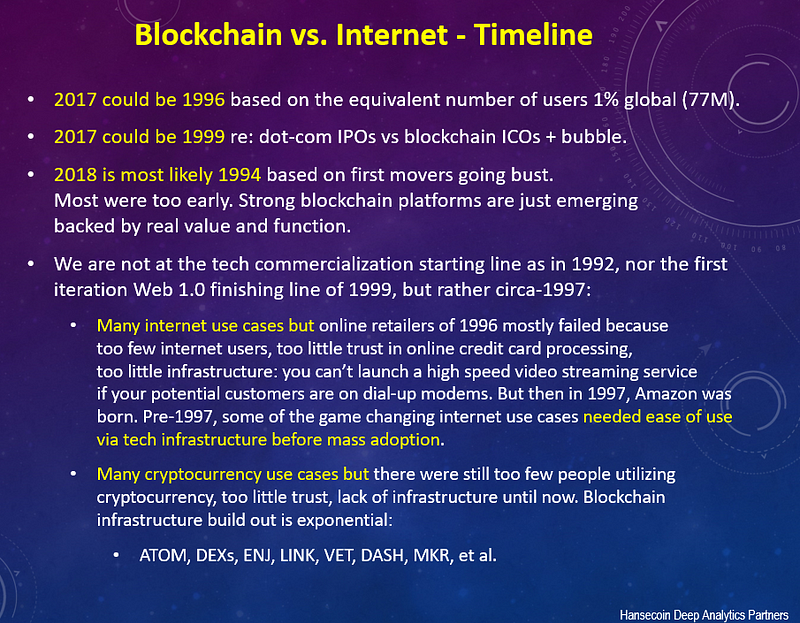

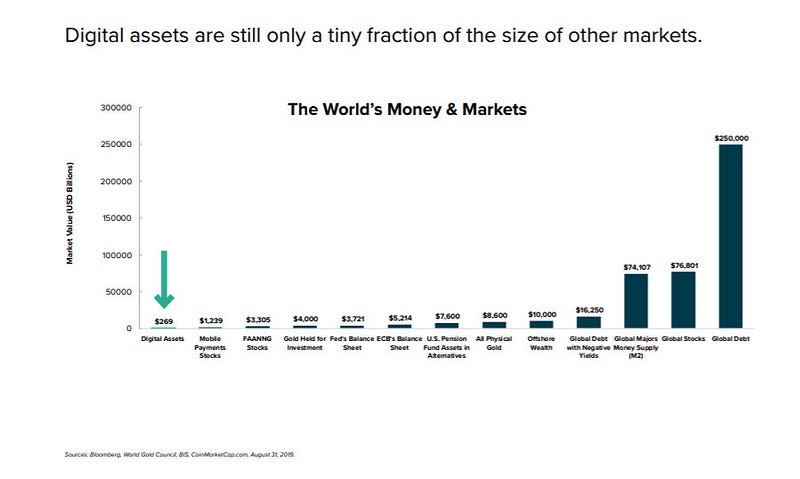

In the late 90s, dot-coms had a huge run but this was due to institutions piling on board. The crypto space has yet to have this occur as 2017 was driven by retail money. In the current bull market, it is highly likely institutions will be a significant factor of the next crypto bull. We are 15 months into the bull market with bitcoin having bottomed in Dec-2018, so another year or two of bull activity in bitcoin and the best alt coins is certainly possible given the numerous tailwinds as well as the guiding light of history.

Here are a few examples of tailwinds at bitcoin’s back. My prediction of $1,000,000/BTC I made in my keynote speech at the FinTech conference in Geneva in Nov-2017 still stands based on bitcoin’s historical price trends and the number of tailwinds in play:

Note on Bitcoin (BTC): My metrics, some of which are shown in the graphics above, have called every major top and bottom in bitcoin within a few weeks or less and sometimes to the day. On January 30, 2018, I personally went to cash selling all my cryptocurrencies on this date due to my metrics issuing a major sell signal in bitcoin. I then only bought Binance (BNB) later in 2018. My 2018 performance was up in 2018 while the median cryptofund performance in 2018: -46% (Source). We then sent out buy signals on GBTC on March 18, 2019.

A couple examples of my buys and sells:

When “thought(less) leaders” such as Nouriel Roubini make declarations that bitcoin has no value, I have refuted the arguments in various published pieces HERE and HERE and HERE as well as in this slide:

Ultimately, the crypto/blockchain space is just getting started. Here’s a comparison of the timeline between blockchain and the internet:

We’re going into a new era. Buckle up!

by Dr. Chris Kacher of Hanse Digital Access, KJA Digital Investments and Virtue of Selfish Investing

(͡:B ͜ʖ ͡:B)